Our Margin calculator will help you calculate the exact margin needed to open your trading position.

How to calculate the margin?

Select your currency pair, account currency (deposit base currency), and margin (leverage) ratio, input your trade size (in units, 1 lot= 100,000 units), and click calculate. The calculator will use the current real-time prices for exact values.

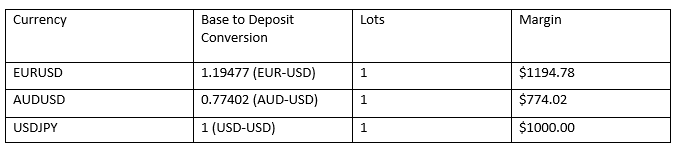

For example, for a USD account with leverage 1:100 and the current forex prices (as of writing), the marginal cost would be:

Why is margin important?

Opening trade with too much margin can quickly lead to a margin call. Opening a trade with insufficient margin could lead to a profitable trade that has little impact on your trading account. Therefore, the required margin should be somewhere between and according to your risk appetite.

What does 1:100 leverage in Forex mean?

If you open an account with $100 and have a leverage of 1:100, this means you have a trading margin of 100*100=$10,000. This could be used to open multiple trades or a single trade, depending on the trade size, while the sum of all used margins cannot exceed $10,000.

How much margin do I have in my account?

That would depend on your account leverage and open positions. Each open trade in your account takes away from your available margin.

For example, a trade of 1 lot EURUSD would require $100,000 times the EURUSD rate in the margin (to convert from base currency to deposit currency), so if the price is 1.1912, this would mean a margin of $119,120, before leverage is applied.

So if you have an account balance of $100 and a leverage of 1:100, open positions with a total margin of $5000, it would mean you’re left with 100*100-5000=$5,000 available margin. Keep in mind that although you can use higher leverage to increase available margin, this would also suggest taking higher risks, so don’t always go for the highest available leverage a broker has to offer.

What is a margin call in Forex?

When you’re trading forex with leverage, this means the broker gives you additional margin to trade with, according to the selected leverage. As this increases your profit, the same goes for losses. To prevent your account from losing more than you’ve deposited, a broker has an automatic process to close all open positions once the margin level reaches a certain percentage (usually 80%) – this is called a margin call.