Forex signals are trading suggestions or recommendations sent to traders, advising them on when to enter or exit a trade. These signals can be generated by professional traders, algorithms, or even market analysis tools. They help traders make informed decisions in the fast-moving world of forex trading.

Forex signals can be beneficial for traders, especially those who are new to the market or lack the time or expertise to analyze the markets themselves. However, it’s crucial to remember that no signal service can guarantee profits, and trading in the Forex market involves inherent risks.

Why Use Forex Signals?

- Save Time: Forex signals eliminate the need for deep technical analysis, saving you hours of market research.

- Expert Guidance: Signals are often provided by experienced traders or experts who have analyzed market trends and potential opportunities.

- Timely Alerts: Signals notify you at the right moment, helping you take advantage of real-time trading opportunities.

Types of Forex Signals

- Manual Forex Signals: Provided by professional traders, these signals are based on in-depth market analysis. Traders manually decide when to share these signals based on various market conditions.

- Automated Forex Signals: Generated by trading algorithms or bots, these signals automatically detect patterns and trends in the market, sending real-time notifications to traders.

Short-Term vs. Long-Term Forex Signals

Short-term signals are trades that last anywhere from 10 minutes to a few hours. These trades typically bring in profits ranging between 15 to 50 pips, depending on how the market moves.

On the other hand, long-term signals can last from one day up to a month or even longer. These signals tend to offer higher profits, with pips ranging from 70 to 250 or more. Market conditions will influence how much you can earn. Whether you prefer short-term or long-term trading, our forex signals cover a wide range of timeframes to suit your needs.

Trading Commodities and Cryptocurrencies with Signals

The commodities market is known for being volatile, but with the right approach, you can make significant profits. We provide trading signals for key commodities such as crude oil (US WTI and UK Brent), gold, silver, platinum, and palladium.

In addition to commodities, cryptocurrencies have emerged as a high-potential trading opportunity. Despite the high risk due to their volatile nature, early adopters of cryptos like Bitcoin and Ethereum have seen massive gains. Our expert team provides signals for top cryptos like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and Dash (DAS). Alongside these signals, we also offer detailed analysis to help you trade confidently.

Forex Signals Performance Report

We provide a detailed profit/loss report for our premium members to track the performance of our forex signals. With a premium account, you can view past data, filter results by instrument, and signal type (short-term or long-term), and even download the report in Excel format to analyze our performance over time.

How Forex Signals Work

Here’s how Forex signals work:

- Signal Generation: Signals can be generated through manual analysis by experienced traders or by automated algorithms. These signals are based on various factors such as technical indicators, economic news releases, market sentiment, and chart patterns.

- Delivery: Forex signals are delivered to traders through different channels such as email, SMS, mobile apps, or dedicated signal platforms. Traders subscribe to signal services to receive these alerts.

- Action: Upon receiving a signal, traders can decide whether to act on it or not. Signals may include information on entry points, stop-loss levels, and take-profit targets to help traders make informed decisions.

- Risk Management: Traders need to manage risk effectively when using Forex signals. This involves setting appropriate stop-loss orders to limit potential losses and managing position sizes based on account balance and risk tolerance.

Key Components of a Forex Signal:

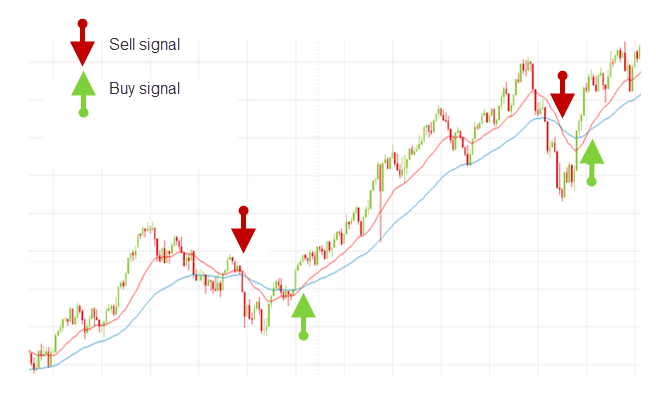

- Buy/Sell Signal

The heart of a forex signal is the trade recommendation—either to Buy or Sell a currency pair or asset. This call-to-action directs traders to open a long (buy) or short (sell) position, aiming to capitalize on market movements. Our signals are timely and precise, ensuring you seize the best trading opportunities in real time. - Stop Loss (SL)

A stop loss is critical for managing risk. It sets a predefined exit point if the market moves against your position, protecting you from excessive losses. By implementing the recommended stop loss, your trade will automatically close before you suffer large drawdowns. At ForexAssociation.co.ke, we prioritize risk management by offering optimized SL levels for every trade recommendation. - Take Profit (TP)

The take profit is the opposite of the stop loss—it’s the level at which your trade will automatically close once a specified profit target is reached. Using our forex signals, you can confidently set your TP knowing that our experts have identified optimal profit levels based on technical analysis and market conditions. - Entry Price

The entry price is where the trade begins. This is the price of the forex pair at the moment the signal is issued. By comparing the entry price with the current market price, you can determine whether the opportunity is still valid or has already passed. ForexAssociation.co.ke ensures that our forex signals are delivered in real-time, giving you the best possible entry points. - Opening Time

Timing is everything in trading. Each signal includes the exact time it was issued, helping you track market movements and respond quickly. This is especially important in fast-moving forex markets where even a few seconds of delay can affect trade outcomes. Our signals are sent through multiple channels, including SMS, WhatsApp, Telegram, email, and on our platform, ensuring you receive them without delay.

Benefits of Using Trading Signals

- Improved Trading Accuracy: Signals provide specific instructions, helping traders avoid guesswork.

- Risk Management: Forex signals usually include stop-loss recommendations, minimizing risk.

- Increased Profit Potential: By following well-timed signals, traders can take advantage of market movements.

Choosing the Right Forex Signal Provider

When selecting a Forex signal provider, consider the following factors:

- Reputation: Choose providers with a proven track record and positive user reviews.

- Signal Accuracy: Look for a provider that offers consistent and reliable signals.

- Customer Support: A good provider will offer support to help traders understand and follow the signals.

Forex Signals for Technical Traders

Many forex traders excel at using technical indicators to analyze price action in currency pairs and identify unique trading opportunities. However, complementing this expertise with forex signals can enhance decision-making. Forex signals rooted in fundamental analysis provide a comprehensive view, helping technical traders understand the broader context before executing trades. Recognizing the underlying factors behind sudden market movements can protect against volatility and position traders to capitalize on significant price shifts.

Sometimes, technical indicators may suggest a certain trend, but actual price movements can diverge from these predictions. By relying on forex signals, traders can gain insights into unexpected price actions, which can help mitigate potential losses and refine their strategies. Combining technical and fundamental analysis leads to more informed trading decisions and increased profitability.

Why Use Forex Signals from ForexAssociation.co.ke?

In a market as volatile as forex, having access to accurate and timely signals can make all the difference. At ForexAssociation.co.ke, our expert traders and advanced trading algorithms analyze the markets to provide high-quality forex signals, helping traders of all experience levels. Whether you’re a beginner or a seasoned trader, our signals guide you through potential trading opportunities with confidence.

Our signals are sent via multiple methods—SMS, email, WhatsApp, Telegram, and our dedicated platform—so you can act quickly no matter where you are. We also offer detailed market analysis to explain the rationale behind each signal, empowering you to learn and grow as a trader.

Stay Ahead with ForexAssociation.co.ke

By using ForexAssociation.co.ke signals, you’re not just following trades—you’re gaining a deeper understanding of the market. Our signals are crafted with the latest market data and trends, providing you with the competitive edge to succeed in forex trading.

If you’re ready to start receiving forex signals that work, join our community today.

Frequently Asked Question About Forex Signals

A trading signal is a suggestion to buy or sell, provided by either a professional trader or trading software. Forex signals give you all the details needed to make a trade, such as the entry price, time, profit target, and stop loss level. These signals are live trade opportunities and can be sent via SMS, email, or shown on a signal provider’s website. A typical forex signal includes:

Buy/Sell: A direct instruction to either buy or sell a currency pair.

Stop Loss: A preset price to exit the trade if it starts losing, to limit potential losses.

Take Profit: A target price at which the trade automatically closes to secure profits.

Entry Price: The price of the currency pair when the signal is issued, allowing you to compare it with the current price before placing the trade.

Opening Time: The time the signal was sent, helping users track the signal in case of delays.

Forex signals are straightforward to use because they give you all the necessary details for trading. A forex signal includes the entry price, the currency pair, whether to buy or sell and the profit and loss targets. Simply follow the instructions: open the trade as soon as you receive the signal to ensure the price you get is close to the suggested entry price.

As a trade recommendation, forex signals clearly provide details like whether to buy or sell, the entry price, take profit and stop loss targets, and the opening time. While these instructions are easy to follow, you don’t have to stick to them exactly. As a trader, you can adjust the take profit target to aim for more profit, move the stop loss to manage your trade, close the trade when you choose, or even ignore the signal if market conditions change quickly.

A signals service is a provider that gives forex signals, either from professional traders and analysts or through automated trading software. Some services offer these signals for free, while others charge a fee.

Forex signals are simple to use. When you receive a signal, you just open a trade based on the provided details: the currency pair, buy/sell action, entry price, take profit, and stop loss levels. Beginners typically follow these instructions closely. More experienced traders might adjust the trade based on their own judgment to potentially increase profits, by tweaking stop loss and take profit levels.

Choosing the best forex signal provider often comes down to their performance. Providers with the highest profit are generally preferred, but it’s important to test their performance to ensure it matches their claims. Forexassociation is a popular provider known for its team of experienced analysts who use various strategies for trade recommendations.

Other factors also contribute to evaluating a signal provider. The timing of when you receive the signal and the risk involved is crucial. Some providers may issue too many signals with large stop losses, increasing risk. Automated signals can be useful but may miss out on critical factors like economic news or geopolitical events. It’s important to consider all these factors to determine the best signal providers for your needs.

As a trader, it’s important to be cautious of false profit claims and do your research before subscribing to a forex signals service. One way to evaluate a service is by adding it to your own market analysis toolkit or testing it on a demo account to see how it performs.

While most signal providers offer genuine trade recommendations, their claimed performance may not always be accurate. To ensure legitimacy, look for services that are transparent about their results. A more transparent service is often a sign of reliable performance.

Conclusion

Forex signals can be an essential tool for both beginner and experienced traders. They simplify trading decisions, saving time and increasing the chances of making profitable trades. Whether you’re new to Forex or looking to enhance your trading strategy, Forex signals can be a powerful addition to your toolkit.

Before using any Forex signal service, traders should research and evaluate the credibility and performance of the provider. Additionally, traders should understand the methodology behind the signals and consider them as one of many tools in their trading arsenal rather than relying solely on signals for trading decisions.