The Importance of Economic Calendars

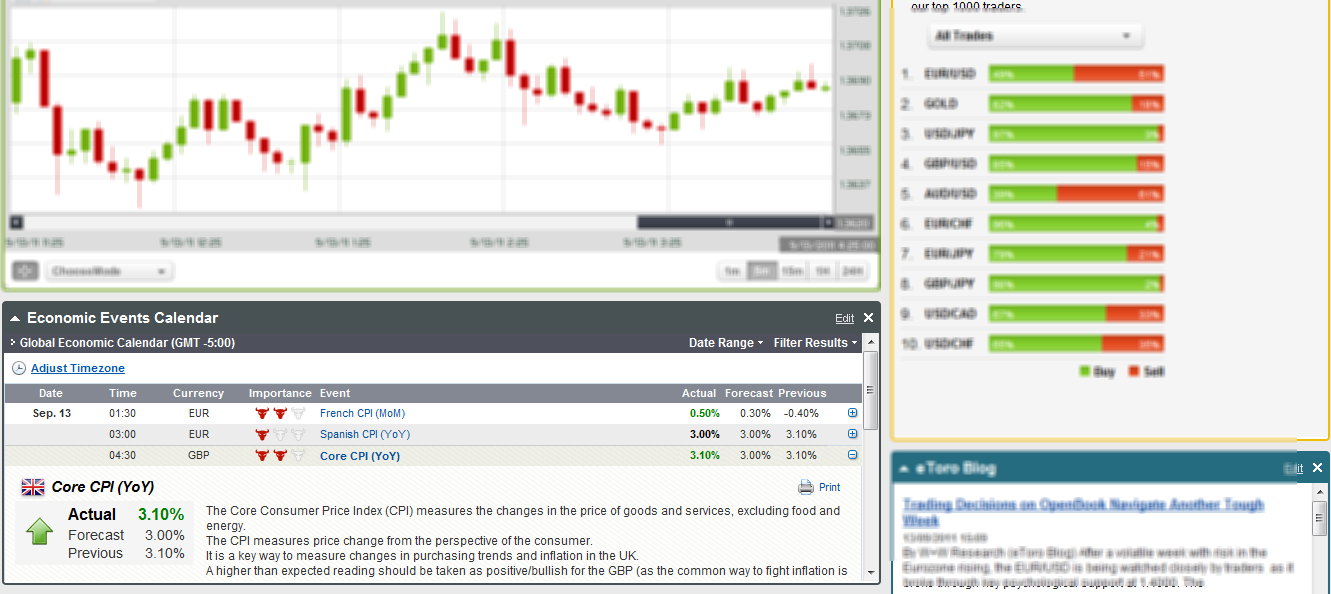

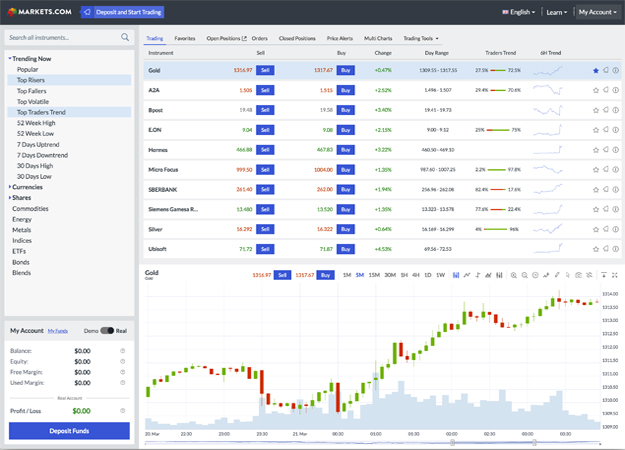

An economic calendar is an important and integral part of your trading platform. It presents all significant economic announcements and releases as well as other fundamental events around the world on a daily basis, which have the potential to impact the market. The best online trading platforms, such as MT4 and MT5, offer calendar services, economic journals that present all significant events from throughout the world. They provide dates, data on each event and forecasts. Calendars contain all kinds of events, such as government announcements, summit conferences, central banks’ releases, reports and more. By using the calendar, you prepare yourself for the main events of the coming week/day. It is possible to trade at the same time as the events or to respond according to market forces as it is happening. However, as we are about to see, there are some events for which good preparations and entry into the market before the coming event can produce higher profits (since you are going to be there before the market responds to the release). This method suits highly experienced traders who do not hesitate to predict. Take a look at eToro’s Economic Calendar:  Markets.com Economic Calendar:

Markets.com Economic Calendar:  Let’s see what to look for in an economic calendar (from left to right):

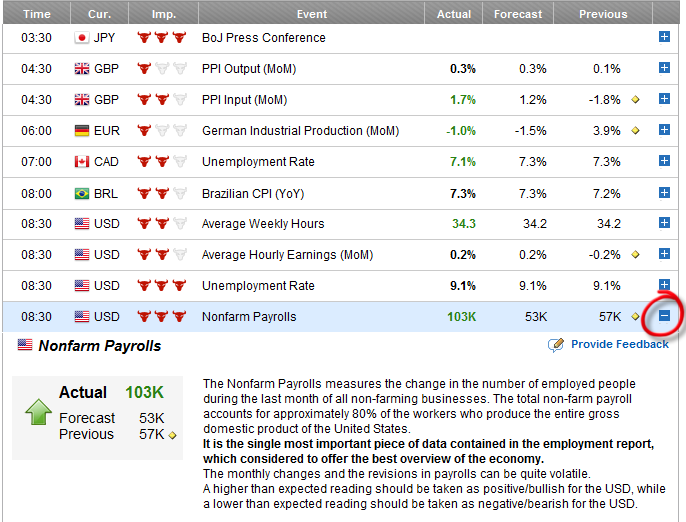

Let’s see what to look for in an economic calendar (from left to right):  Source eToro.com Economic Calendar services by Forexpros Time – The time of the event Currency – The currency which is affected Importance – The level of importance on the market and on the currency Event – In a headline (the name of the event). By pressing the ‘+ buttons’ to the right you open a detailed box on the specific event, including explanations of its impact Actual – The actual release (Green means better than expected while red means worse than expected. Black means as expected). Forecast – The predicted numbers by the consensus Previous – The previous release

Source eToro.com Economic Calendar services by Forexpros Time – The time of the event Currency – The currency which is affected Importance – The level of importance on the market and on the currency Event – In a headline (the name of the event). By pressing the ‘+ buttons’ to the right you open a detailed box on the specific event, including explanations of its impact Actual – The actual release (Green means better than expected while red means worse than expected. Black means as expected). Forecast – The predicted numbers by the consensus Previous – The previous release

The Power of Expectations

In some cases, expectations alone can affect major price movements. There are events that create a buzz, thereby causing major transactions and heavy traffic in pips as a result. Major events can be reports on employment or central banks’ announcements concerning the interest rate, for example. Expectations alone might cause tens of pips to move, even up to 100 pips, all prior to the actual event! The reason for this is that many traders and speculators prepare themselves just before the coming event. (Assume that the event presents a totally different than expected scenario, the reaction would be a drastic price reversal, which in fact creates another fantastic opportunity to get into session and open a position). Consensus System – Before every major event, all kinds of professional analyses forecast the results. The majority of them come to a decision and a consensus is created. The heavy players do not wait for the actual results. They start buying or selling. So, large transactions start just before release, and obviously before the small “fishes” get into the market. The effect of the Consensus is that if the results match expectations, we are not really going to see a high volume of transactions because they have been already made. But! If we witness a surprising announcement, for better or worse, we should expect a massive rally! Why? Because all major players are in a hurry to fix their previous moves! Here is a great opportunity to make some money! That is what the Consensus System is all about. Let’s take interest rates for instance: speculators around the world prepare themselves with expectations prior to the central bank’s release on the interest rate. We will be able to view intense trends prior to the announcement. An announcement that is different than expected will be followed by even more intense trends. Remember: Many traders (mostly ordinary speculators) still prefer the more solid and safe “Non-Directional Bias” system, which generally says to follow the rules, wait for the event to happen and only than to decide what to do, based on whether it is good or bad for the currency.

In Conclusion

The most influential news comes from the U.S., considered the number 1 economic force in the world (and also due to its currency, which is the most traded currency in the world). Fundamental analysis works very well in the majors. Majors are strongly affected by global events, and in addition, commissions on majors are relatively lower. Important: It is advised to look at the whole picture. There are usually several news releases and economic events taking place at the same time, affecting the market simultaneously, and in different ways. For instance, if the number of unemployed in the U.S. was down last month, but the dollar still declines, the reason might be that in the long-term, the tendency is still negative, and investors cannot decide if it is the right time to buy dollars. Another possible reason is that despite encouraging numbers in the latest report, general numbers are still disappointing. A third reason might be the timing influence of the release: is it right after Christmas or next to another important holiday (periods that are characterized by a large, temporary workforce)? Pay attention:

- Who is the source for this event (Analysts, traders, a bank, central banks, etc.)? Sources such as governments and central banks usually are more trustworthy. That’s not the case for authoritarian or semi-authoritarian countries such as China, Russia, or Turkey. They tend to manipulate the data to make a better impression to suit their agenda on the domestic and international fronts.

- Is it by way of rumors, facts or opinions?

- You should pay attention to the wording: as expected/better than expected/worse than…etc. Remember that experienced traders have already made their positions based on their expectations.

- Pay attention to changes in price during the hours before the expected announcement.

- Fundamental analyses are usually accurate. Most of the time they will analyze market conditions and their implications. Although, sometimes, the market doesn’t agree with the fundamentals. From 2012 until 2014, EUR/USD stubbornly kept following a 2,000 pip uptrend despite the fiscal troubles in Greece, the economic slowdown in Europe and the impressive recovery of the US economy. The problem is that they relate to long periods, which makes it very hard to predict the exact timing of the expected trend. When exactly is it going to appear? Good question…

- Monetary bodies’ past behavior provides us with very good indications regarding future behavior.

Tip: It’s better to make as many comparisons of reports on interest rates and inflation as you can. Compare reports to previous periods and other markets in order to make an educated decision on which currency go short and which to go long.

Practice

It is time to go back to your demo accounts. Is the platform open in front of you? Let’s revise what we have been studying in this lesson:

- Look for the site’s calendar. Found it? Check out a few of the events being presented. Try to read and understand them, figure out what their consequences might be. How might they affect the market?

- Distinguish between past events and future events; notice expected dates of announcements. Notice that there are forecasts on some of the events

- Wander around among a few of the major news sites, such as Bloomberg for example. Go to FXLeaders.com and study it