Having met Mr. Fibonacci, it’s time to get to know some other popular technical indicators. The indicators you are about to learn about are formulas and mathematical tools. As prices shift all the time, the indicators help us put prices into patterns and systems. Technical indicators are on the trading platforms for us, operating on the charts themselves, or beneath them.

More Technical Indicators

- Moving Averages

- RSI

- Bollinger Bands

- MACD

- Stochastic

- ADX

- SAR

- Pivot Points

- Summary

Important: Although there are a wide variety of technical indicators, you don’t have to use them all! In fact, the contrary is true! Traders should not use too many tools. They will just become confusing. Working with more than 3 tools will slow you down and cause mistakes. As in every other area in life, there is a point on the advancement graph that once breached, efficiency starts to drop. The idea is to choose 2 to 3 powerful, effective tools and to feel comfortable working with them (and more importantly, ones that help you achieve good results). Tip: We do not recommend using more than two indicators simultaneously, especially not during your first couple of months. You should master the indicators one at the time and then combine two or three of them. The indicators which we are going to present to you are our favorites and in our own opinion, the most successful ones. Be consistent with which tool you work with. Think of them as an index of formulas for a mathematics exam – you can study them perfectly in theory, but unless you run a few exercises and sample tests you will not truly have control and know how to use them! Back to business: We mentioned that indicators are formulas. These formulas are based on past and present prices in order to try to foresee the expected price. The Indicators box is situated in the chart Tools Tab (or Indicators Tab), on the trading platforms. Let’s see how it looks like on eToro’s WebTrader platform:

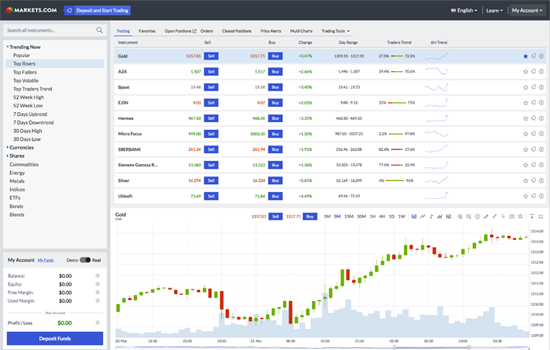

See how it looks the Markets.com trading platform:

See how it looks the Markets.com trading platform: AVA Trader web platform:

AVA Trader web platform:  Now, time to meet our indicators:

Now, time to meet our indicators: