RSI (Relative Strength Index)

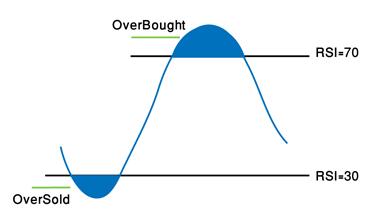

One of the few Oscillators that you will learn about. RSI operates as an elevator that moves up and down on the market’s momentum scale, checking a pair’s strength. It belongs to the group of indicators that are presented beneath the chart, in a separate section. RSI is very popular among technical traders. The scale on which RSI moves is 0 to 100. Strong milestones are 30′ for oversold conditions (price below 30′ sets an excellent Buy signal), and 70′ for overbought conditions (price above 70′ sets an excellent Sell signal). Other good points (although riskier, for more aggressive traders) are 15′ and 85′. Conservative traders prefer to work with point 50′ for identifying trends. Crossing 50′ indicates that the reversal has been completed.  Let’s see how it looks on the trading platform:

Let’s see how it looks on the trading platform:  On the left-hand side, higher than 70′ the RSI signals a coming downtrend; crossing the 50′ level confirms the downtrend, and going below 30′ indicates on an oversold condition. Time to think of exiting your SELL position. Pay attention on the next chart to breached points 15 and 85 (circled), and to the following change in direction:

On the left-hand side, higher than 70′ the RSI signals a coming downtrend; crossing the 50′ level confirms the downtrend, and going below 30′ indicates on an oversold condition. Time to think of exiting your SELL position. Pay attention on the next chart to breached points 15 and 85 (circled), and to the following change in direction: