In Forex, as in all economic markets, the name of the game is supply and demand. The stronger a currency gets, the larger the global demand for the currency becomes. Several elements impact currency supply, such as inflation, money printing by the central bank, etc. Elements affecting demand can include positive growth signals from the national economy or investors creating demand for a currency by wishing to invest in the national market.

Market Sentiment

The names for the market’s general “state of mind.” It influences supply and demand for different currencies. Market sentiment expresses the feelings and beliefs of the majority of traders about the market. Sometimes it will be opposite to your own analysis or expectations, but you must understand that it reflects the majority point of view. You can’t tell yourself: “Everyone is wrong, and I am right.” If the majority chooses a certain direction, it is the relevant direction for now. If a price goes up, it means that most traders feel that way right now, so the demand for this pair goes up.

Lines & Trends

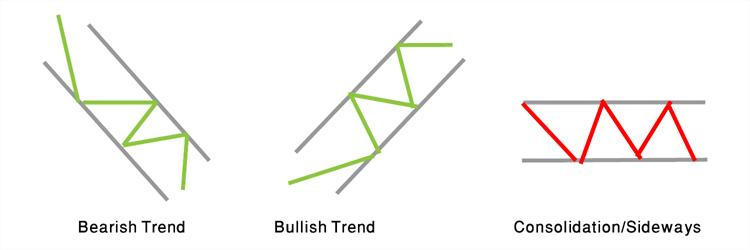

Trends are the essence of Forex trading. They are the basis for all of our executions. The trend is your friend if you learn to follow and identify them correctly. What is a trend? Charts move forward in three possible directions: Up (uptrend), Down (Downtrend), and Flat (Ranging/ Sideways trend). Each trend is characterized by highs (peaks) and lows (troughs). The trend is the prime factor affecting traders’ actions. In Forex jargon, an uptrend is called Bullish (when buying a pair, we actually go bullish or go long), and a downtrend is called Bearish (when selling a pair, we go bearish or short). Notice that in a bullish trend, each peak is lower than its sequential, and vice versa in a bearish trend.  A range-type trend is usually easy to identify because a trader can visualize a rectangle-like shape that marks the trend. It is a neutral trend, with the price unable to break out either upward or downward. During this period, buying at the bottom and selling at the top is best. It’s a pretty straightforward strategy. An example of a ranging trend:

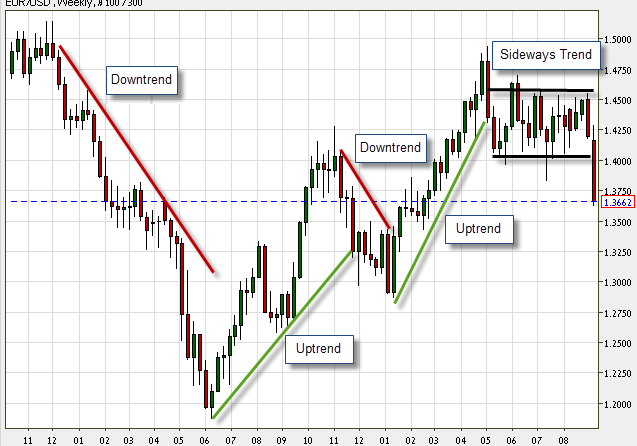

A range-type trend is usually easy to identify because a trader can visualize a rectangle-like shape that marks the trend. It is a neutral trend, with the price unable to break out either upward or downward. During this period, buying at the bottom and selling at the top is best. It’s a pretty straightforward strategy. An example of a ranging trend:  The most important thing to know about a trend is its length and consistency. Remember: a trend must contain at least two peaks or two lows to be considered as a trend. If it includes three or even more points, we can be quite certain that we are looking at a relatively solid trend. Trend Lines – the essential technical tool for trend analysis. This is the first technical tool you will meet in the course. It is a basic, simple, and easy-to-operate tool (You can find it in the toolbox window above the chart on your trading platform). It is also the most popular tool among Forex traders. Using a pencil drawing on the platform, you can draw a line connecting peaks to peaks and lows to lows along the trend. This trend line will now help you recognize a trend’s direction. Necessary: Draw your lines correctly. In other words, do not match your line to the market, but rather the market to your line! Remember: It is often possible to identify changes in the trend’s direction by following breaks in the trend lines. See the examples below:

The most important thing to know about a trend is its length and consistency. Remember: a trend must contain at least two peaks or two lows to be considered as a trend. If it includes three or even more points, we can be quite certain that we are looking at a relatively solid trend. Trend Lines – the essential technical tool for trend analysis. This is the first technical tool you will meet in the course. It is a basic, simple, and easy-to-operate tool (You can find it in the toolbox window above the chart on your trading platform). It is also the most popular tool among Forex traders. Using a pencil drawing on the platform, you can draw a line connecting peaks to peaks and lows to lows along the trend. This trend line will now help you recognize a trend’s direction. Necessary: Draw your lines correctly. In other words, do not match your line to the market, but rather the market to your line! Remember: It is often possible to identify changes in the trend’s direction by following breaks in the trend lines. See the examples below:  The blue line in the middle represents the current price (In our case, 1.3662). You will notice that the last candlestick ends at this price. Another example of trend lines in the Forex market:

The blue line in the middle represents the current price (In our case, 1.3662). You will notice that the last candlestick ends at this price. Another example of trend lines in the Forex market:

Time Frames

For your convenience, we organized this subject in a table detailing the different time frames:

| Time Frame | Details | Pros | Cons |

| Long-term (Investors) | Hold trades for a few weeks to a few months or even years. Popular charts are daily and weekly charts. | There is no need to follow the market constantly. It is time to think about each trade and analyze it. Aim for high potential profits per position. Fewer positions mean less spreads to pay the brokers. | A lot of patience is required. Potentially longer losing periods (more losing months). A large capital amount is required (to enjoy long-term trends). The winning potential is smaller when the trend is not strong. |

| Short-term (Swingers) | Hold trades for a few hours up to a week. Popular charts are 1-hour chart, 4-hour, and daily. | More trading opportunities. Not reliant upon a small number of winning trades throughout the year. More dynamic trading. Many trading opportunities during ranging periods. Less capital requirement. | More transaction costs (more spreads on opening positions). Overnight risks (uncertainty regarding open positions). Vulnerable to sudden volatile moves. |

| Intraday (Day Traders) | Hold trades intraday, anything from a few minutes until the day’s end. Popular charts are 1-minute chart, 5-minute, and 15 minutes. | Many trading opportunities each day. Money is scattered across a more significant number of options. No overnight risk. | Profits are limited (trades close with the market every day). Much more costs (many spreads to pay). Demands constant involvement – can cause mental stress. |