Opening and Closing Positions

You are about to learn very simple, intuitive, and basic trading strategies that summarize parts of the material so far very well. Swing Trade – A short-term trading strategy. Usually, it lasts from a couple of days to a week. The goal of this strategy is to ride existing market trends and to take as much advantage of them as you can, to make relatively quick profits, while reacting fast to changes in market behavior. The idea is to ride the wave. Every major trend is built of groups of waves. The method is to decide when to buy and sell by observing the waves. Fibonacci to our rescue again:  Once again, only this time with Fibonacci – let’s take a closer look at the inner trends in the second part of the general uptrend – or as they are called – ‘trend within a trend’. That name comes from the smaller timeframe charts, if you look at the 4-hour chart you will see the bigger uptrend. But, if you change to smaller timeframes during the retrace, such as the 15-minute chart, all you can see is a downtrend. We will check if a healthy pullback actually occurs (when the pullback meets the Fibonacci criteria inside the overall trend):

Once again, only this time with Fibonacci – let’s take a closer look at the inner trends in the second part of the general uptrend – or as they are called – ‘trend within a trend’. That name comes from the smaller timeframe charts, if you look at the 4-hour chart you will see the bigger uptrend. But, if you change to smaller timeframes during the retrace, such as the 15-minute chart, all you can see is a downtrend. We will check if a healthy pullback actually occurs (when the pullback meets the Fibonacci criteria inside the overall trend):  Two waves up, approximately the same size, two corrections, twice on ratio 0.50 or the 50% Fibonacci retracement level – We have a pattern. There are good chances for the swinging uptrend to continue! Two important points to take into consideration:

Two waves up, approximately the same size, two corrections, twice on ratio 0.50 or the 50% Fibonacci retracement level – We have a pattern. There are good chances for the swinging uptrend to continue! Two important points to take into consideration:

- Having a trading plan is crucial in this business. The plan might not be precisely the same for every trade, i.e., you might alter it from one trade to another depending on the analysis, but having a trading plan is a must. Don’t be too aggressive by trying to win the whole trend. It is impossible to predict the peaks and lows precisely. Don’t force yourself if you are late on a specific trend. Wait for the next one to arrive! As the saying in forex goes, please don’t follow the price; let it come to you.

- Set Stop Losses. This is extremely important! We strongly advise you to set them on each and every one of your positions! Get used to working with ‘stop loss’ and ‘take profit’ orders.

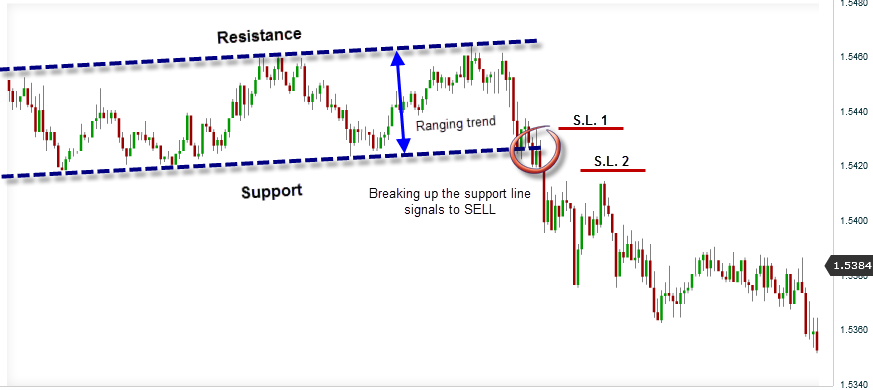

Breakouts – The Breakout strategy is efficient mainly for ranging trend conditions. In this method, we look at the support and resistance level. Once we identify a breakout, that would be our entry point, following the expectation that the trend will follow that direction:  Do not forget to set a Stop Loss! In our example, we placed it a fraction above the breakout point (in case we witness a fake-out, meaning we are wrong!). Once the price has gained some distance from our entry point, we can shift our Stop Loss a little further down, below our entry point. Many forex platforms, such as the MT4 and MT5, now offer the option if a trailing stop loss. It means that you place a stop loss (say 50 pips) and as the trade moves deeper in profit, your stop loss keeps moving in the same direction, increasing the profit potential even if it is triggered. Remember: To ensure profits move your Stop Loss toward the trend!

Do not forget to set a Stop Loss! In our example, we placed it a fraction above the breakout point (in case we witness a fake-out, meaning we are wrong!). Once the price has gained some distance from our entry point, we can shift our Stop Loss a little further down, below our entry point. Many forex platforms, such as the MT4 and MT5, now offer the option if a trailing stop loss. It means that you place a stop loss (say 50 pips) and as the trade moves deeper in profit, your stop loss keeps moving in the same direction, increasing the profit potential even if it is triggered. Remember: To ensure profits move your Stop Loss toward the trend!

- Triangles are fantastic tools (you met them a few lessons ago) for the Breakout strategy:

When the triangle is symmetrical, the situation is a little different. A breakout can occur on both sides, therefore we activate an OCO action (One Cancel the Other). We set 2 entries – one above the vertex and the other below it. You must remember to cancel the one that turns out to be contrary to the new direction of the trend:

When the triangle is symmetrical, the situation is a little different. A breakout can occur on both sides, therefore we activate an OCO action (One Cancel the Other). We set 2 entries – one above the vertex and the other below it. You must remember to cancel the one that turns out to be contrary to the new direction of the trend: