Market Volatility

The volatility of a given pair determines how risky it is to trade. The stronger the market volatility, the riskier it is to trade with this pair. On the one hand, strong volatility creates great earning options due to the many powerful trends. On the other hand, it could cause quick, painful losses. Volatility is derived from fundamental events that influence the market. The less stable and solid the economy, the more volatile the charts will be. If we look at the major currencies, The most secure and stable majors are USD, CHF, and JPY. These three majors are used as reserve currencies. The central banks of most developed economies hold these currencies. This has an inevitable, major impact on both the global economy and exchange rates. USD, JPY, and CHF constitute most of the global currency reserves. EUR and GBP are also powerful, but they have been considered less stable in recent years – their volatility is higher—particularly the GBP after the Brexit referendum. The Euro lost about five cents after the referendum, while the GBP lost more than 20 cents, and the trading range in GBP pairs remains several hundred pips wide. How to determine the level of volatility of a certain forex pair: Moving Average: Moving Averages help traders follow the ups and downs of a pair during any period by examining the pair’s history. Bollinger Bands: When the channel becomes wider, volatility is high. This tool evaluates the current status of the pair. ATR: This tool collects averages throughout chosen periods. The higher the ATR, the stronger the volatility, and vice versa. ATR represents historical evaluation.

Stop Loss Settings: How, Where, When

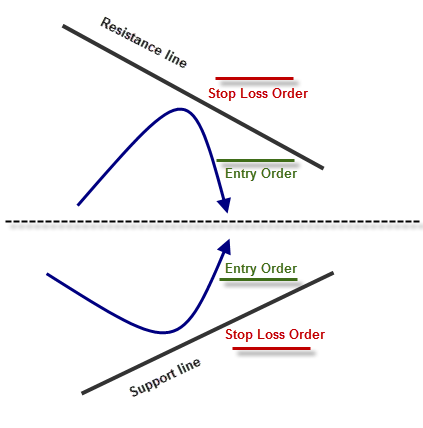

We have emphasized this numerous times throughout the course. There isn’t one person in the world, not even Mr. Warren Buffett himself, who can predict all price movements. There is no trader, brokerage or bank that can foresee every trend at any given time. Sometimes, Forex is unexpected and may cause losses if we are not careful. No one could predict the social revolutions in the Arab markets at the beginning of 2011 or the major earthquake in Japan. Yet, fundamental events like these have left their marks on the global Forex market! Stop Loss is a very important technique designed to reduce our losses when the market behaves differently than our trades. Stop Loss plays a critical role in every successful trading plan. Think about it – sooner or later, you will make mistakes leading to losses. The idea is to reduce losses as much as possible while expanding your earnings. A Stop Loss order allows us to survive bad, losing days. Stop Loss exists in every online trading platform. It is executed when we give the order. It appears next to the price quotation and call for action (Buy/Sell). How should you set a stop loss order? Place a stop loss sell order on long positions just below the support level and a stop loss buy order on short positions just above the resistance. For example, if you want to go long on EUR at USD 1.1024, a recommended stop order should be a little lower than the current price, say around USD 1.0985. How to set your Stop Loss: Equity Stop: Determine how much you are willing to risk from our total amount in percentage terms. Assume you have $1,000 in your account when deciding to enter a trade. After thinking for a few seconds, you decide that you are willing to lose 3% of your total USD 1,000. This means that you can afford to lose up to USD 30. You will set the Stop Loss below your buying price, in a way that will permit a maximum potential loss of USD 30. That way, you will be left with USD 970 in the event of a loss. At this point, the broker will automatically sell your pair and remove you from the trade. More aggressive traders set stop-loss orders around 5% distant from their purchase price. Solid traders are usually willing to risk around 1%-2% of their capital. The main problem with equity stop is that while it takes the trader’s financial condition into consideration, it doesn’t consider current market conditions at all. A trader is examining himself instead of examining trends and signals produced by the indicators he uses. In our opinion, it is the least skillful method! We believe that traders have to set a Stop Loss according to market conditions and not based on how much they are willing to risk. Example: Suppose you opened a USD 500 account and want to trade a USD 10,000 lot (a standard lot) with your money. You wish to put 4% of your capital at risk (USD 20). Each pip is worth USD 1 (we have already taught you that in standard lots, each pip is worth one currency unit). According to the equity method, you would set your stop loss 20 pips away from the resistance level (you plan to enter the trend when the price reaches the resistance level). You choose to trade the pair EUR/JPY. It is very important to know that when trading the majors, a 20 pips move might last just a few seconds. This means that even if you are right in your overall predictions on a future trend’s direction, you might not get to enjoy it because just before the price went up, it slipped back and touched your Stop Loss. That´s why you must place your stop at reasonable levels. If you can’t afford it because your account is not big enough, then you must use some money management techniques and probably reduce the leverage. Let’s see what a stop loss looks like on the chart:  ↓

↓  Chart Stop: Setting a Stop Loss not based on price but according to a graphical point on the chart, around support and resistance levels for instance. Chart Stop is an effective and logical method. It gives us a safety net for an expected trend that has not taken place yet. Chart Stop can either be determined by you in advance (Fibonacci levels are recommended areas for setting a Stop Loss) or under a specific condition (you can decide if the price reaches a crossover point or a breakout, you close the position). We recommend working with Chart Stop Losses. For example, if you plan to enter a BUY order when the price reaches the 38.2% level, you would set your Stop Loss between levels 38.2% and 50%. Another option would be to set your Stop Loss just below the 50% level. By doing so, you would give your position a bigger chance, but this is considered to be a slightly more dangerous decision that might cause more losses if you are wrong! Volatility Stop: This technique was created to prevent us from exiting trades due to temporary volatile trends that are caused by current pressure among traders. It is recommended for long-term trading. This technique is based on the claim that prices move according to a clear and routine pattern, as long as there is no major fundamental news. It works on expectations that a certain pair is supposed to move during a time period within a given pips range. For example: if you know that EUR/GBP has moved an average of 100 pips a day throughout the past month, you would not set your Stop Loss 20 pips from the opening price of the current trend. That would be inefficient. You would probably lose your position not because of an unexpected trend but because of the standard volatility of this market. Tip: Bollinger Bands are an excellent tool for this Stop Loss method, setting a Stop Loss outside the bands. Time Stop: Setting a point according to a time frame. This is effective when the session has already been stuck for a long period (price is very stable). The 5 Don’ts:

Chart Stop: Setting a Stop Loss not based on price but according to a graphical point on the chart, around support and resistance levels for instance. Chart Stop is an effective and logical method. It gives us a safety net for an expected trend that has not taken place yet. Chart Stop can either be determined by you in advance (Fibonacci levels are recommended areas for setting a Stop Loss) or under a specific condition (you can decide if the price reaches a crossover point or a breakout, you close the position). We recommend working with Chart Stop Losses. For example, if you plan to enter a BUY order when the price reaches the 38.2% level, you would set your Stop Loss between levels 38.2% and 50%. Another option would be to set your Stop Loss just below the 50% level. By doing so, you would give your position a bigger chance, but this is considered to be a slightly more dangerous decision that might cause more losses if you are wrong! Volatility Stop: This technique was created to prevent us from exiting trades due to temporary volatile trends that are caused by current pressure among traders. It is recommended for long-term trading. This technique is based on the claim that prices move according to a clear and routine pattern, as long as there is no major fundamental news. It works on expectations that a certain pair is supposed to move during a time period within a given pips range. For example: if you know that EUR/GBP has moved an average of 100 pips a day throughout the past month, you would not set your Stop Loss 20 pips from the opening price of the current trend. That would be inefficient. You would probably lose your position not because of an unexpected trend but because of the standard volatility of this market. Tip: Bollinger Bands are an excellent tool for this Stop Loss method, setting a Stop Loss outside the bands. Time Stop: Setting a point according to a time frame. This is effective when the session has already been stuck for a long period (price is very stable). The 5 Don’ts:

- Don’t set your Stop Loss too close to the current price. You don’t want to “strangle” the currency. You want it to be able to move.

- Don’t set your Stop Loss according to position sizing, meaning according to the amount of money that you wish to put at risk. Think of a poker game: it is the same as deciding upfront that you are willing to put on the next round up to USD 100 maximum, out of your USD 500. It would be silly if a pair of Aces appears…

- Don’t set your Stop Loss precisely on the support and resistance levels. That’s a mistake! To improve your chances you need to give it a little space, as we have already shown you countless cases where the price broke these levels by just a few pips or for a short time but then moved right back.

Remember- levels represent areas, not specific points!

Remember- levels represent areas, not specific points!

- Don’t set your Stop Loss too far from the current price. It may cost you a lot of money just because you didn’t pay attention or looked for an unnecessary adventure.

- Please don’t change your decisions after making them! Stick to your plan! The only case in which it is advised to reset your Stop Loss is in case you are winning! If your position makes profits, you had better move your Stop Loss towards your profitable zone.

Don’t expand your losses. By doing so, you let your emotions take over your trading, and emotions are the biggest enemies of experienced pros! This is like entering a poker game with a budget of USD 500 and buying USD 500 more after losing the first USD 500. You can guess how it might end – big losses