MACD (Moving Average Convergence Divergence)

MACD is shown beneath the charts, in a separate section. It is built of two moving averages (short-term and long-term) plus a histogram that measures their gaps. In simple terms – It is an average of two different timeframes’ averages. It is not the prices average! Tip: The most important area in the MACD is the intersection of the two lines. This method is very good at spotting reversals of trends in good time. Disadvantage – You need to remember that you are watching averages of past averages. That is why they lag behind real-time price changes. Still, it is quite an effective tool. Example: Pay attention to the intersections of the long average (green line) and the short (red). See on the price chart how well they alert to a changing trend.  Tip: MACD + Trend line work well together. Combining MACD with the Trend line may show strong signals that tell us of a breakout:

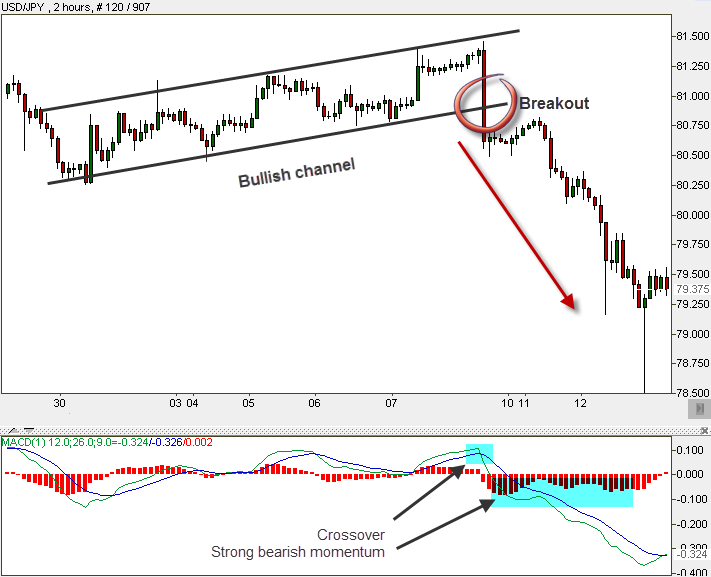

Tip: MACD + Trend line work well together. Combining MACD with the Trend line may show strong signals that tell us of a breakout:  Notice the duplication between the Trendline’s alert and the MACD’s alert (Sell signals). Tip: MACD + Channels are also a good combination:

Notice the duplication between the Trendline’s alert and the MACD’s alert (Sell signals). Tip: MACD + Channels are also a good combination: