Forex Signals – Follow live market updates.

A Forex signal is an online trading alert on the currency pairs, indicating fresh trading opportunities. Signals services allow you to follow and copy trading actions and executions from experienced and successful traders. The providers of these alert services spot opportunities by using technical tools and fundamentals. Alerts are provided by analysts who perform their moves in real-time or by automated systems, like robots, which analyze the market using sophisticated algorithms. A signal’s quality depends on its success percentage, the simplicity of performance, system efficiency, and speed. Forex signals can be provided via websites, Emails, SMS, or tweets. Who are these services recommended for? Following alerts can be a terrific trading strategy if you:

- Lack the time or energy to trade for yourself and maintain your trades

- Look for extra income from as little effort as possible

- Do you want to open more than one or two positions simultaneously? (it can be a great idea to open a couple of positions based on market alerts, side by side with your trading positions.)

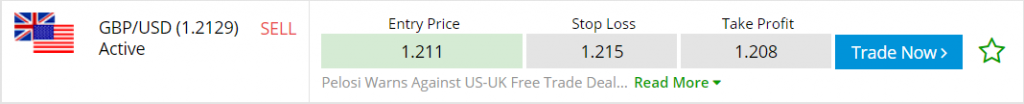

How do market alerts work? To learn what an excellent live Forex signal includes, take a look at how Chweya signals are provided:

- The pair – the relevant currency pair.

- Action – trading signal telling you to buy or sell the pair.

- Optional ‘Stop Loss’ and ‘Take Profit’ orders – traders using alerts are strongly advised to use Stop Loss orders when opening positions. All of Chweya’s trading alerts are provided with Stop Loss and Take Profit orders.

- Status – The status of the alert signal. Active means an open signal. If an alert is active, traders are advised to follow it and enter the market.

- Comments – appear whenever there is a live update regarding the signal.

- Trade Now – go to the trading platform and open a position.

Follow the experts … for free! Chweya alerts are entirely FREE! On our Forex signals alert page, you can find daily live market updates, suggesting trading strategies on indices, commodities, and currency pairs!

What Not To Do

We’ve prepared for you a list of “7 Forex commandments”. Follow them carefully to trade like the pros:

- Don’t trade blindly following other traders’ opinions or analyses unless you understand the reasons behind their opinions and agree with them. Trust your judgments

- Don’t change your strategy in the middle of open positions. Do not reset your Stop Loss points. Don’t let your emotions and fear of failure control your decisions.

- Remember to treat trading as a business. Don’t be smug, too enthusiastic, or careless. Act Responsibly!

- Enter trades only if you find good enough reasons that support your decisions. Don’t open positions just “for fun” or out of boredom. Forex is not supposed to provide you with entertainment. If too much emotion is involved, then you’re probably not trading right. Forex is not considered to be exciting like gambling.

- Don’t be too hasty to exit a trade. Neither when winning or losing. Stick to your plan and close positions only when you feel the market behaves opposite to your earlier assumptions.

- Don’t use high leverage. Also, remember that the level of leverage must affect where you place your Stop Loss; placing it too close to your entrance price while using leverage can quickly erase your position.

- Don’t try to run too fast! Forex involves risk, but it isn’t Bellagio’s casino! Practice a little first, get to know your platform, don’t open too many positions at the same time, and be careful not to put your entire capital on the line for a single position.