It’s time to learn more about the market. Our step-by-step journey through Forex continues. So before jumping into the deep water, let’s wet our feet first, get used to the temperature… and focus on the following forex trading terms:

- Currency pairs: Major currencies, Cross currencies, and Exotic pairs

- Trading hours

- It’s time to begin!

Currency Pairs

In Forex trading we trade in pairs. There is a constant struggle between the two currencies that make up the pair. If we take the EUR/USD, for example: When the euro gets stronger, it comes at the expense of the dollar (which weakens). Reminder: If you think that a certain currency will get stronger against another currency (“go long”, or “go bullish” in the Forex jargon) you should buy it. If you think a currency will get weaker (“go short”, “go bearish”) sell. There are many currency pairs, but we are going to focus on 3 central groups: The Majors (Major currency pairs): The A-List of currencies. The Majors are a group of the 8 most traded currency pairs. These are the most powerful and popular pairs in the market. That means that trades on these pairs are much more liquid. Majors are traded in high volumes, which make the trends more significant. Majors are influenced by the news and economic events worldwide on a daily basis. One of the reasons these currencies are the most traded and considered majors is that they are the currencies of developed and democratic nations, where all economic events are transparent and lack manipulation by authorities. All majors have a common denominator – the U.S. Dollar, which appears in all of them as one of the two currencies. Most of the markets in the world hold U.S. dollars in their capital inventories, and many governments trade dollars. Did you know that the entire global oil market is traded with dollars? It’s time to meet the majors:

| Countries | Pair |

|---|---|

| Euro Zone / United States | EUR/USD |

| United Kingdom / United States | GBP/USD |

| United States / Japan | USD/JPY |

| United States / Canada | USD/CAD |

| United States / Switzerland | USD/CHF |

| Australia / United States | AUD/USD |

| New Zealand / United States | NZD/USD |

Tip: Our advice to beginners is to start trading the majors. Why? Trends are usually longer, the opportunities are endless, and the economic news covers them all the time! Cross Pairs (Minors): Pairs which do not include the USD. These pairs can be very interesting trading options because by using them we cut off our reliance on the dollar. Minors suit creative and seasoned traders who are familiar with global economic events. Due to the relatively low volume of trades they represent (less than 10% of all Forex transactions) trends on these pairs are often more solid, moderate, slow and free of strong pullbacks and reversal trends. Central currencies in this group are EUR, JPY, and GBP. Popular pairs are:

| Countries | Pair |

|---|---|

| Euro, United Kingdom | EUR/GBP |

| Euro, Canada | EUR/CAD |

| United Kingdom, Japan | GBP/JPY |

| Euro, Switzerland | EUR/CHF |

| United Kingdom, Australia | GBP/AUD |

| Euro, Australia | EUR/AUD |

| Euro, Canada | EUR/CAD |

| United Kingdom, Canada | GBP/CAD |

| United Kingdom, Switzerland | GBP/CHF |

Example: Let’s look at the pair EUR/JPY. Say, events with negative impact on the Yen are taking place in Japan these days (the Japanese government is planning to inject more than 20 trillion Yen to help the economy and increase inflation), and at the same time we have heard some mildly positive news for the Euro at a press conference of the ECB president Mario Draghi. We are talking about great conditions for trading this pair by selling JPY and buying EUR! When a certain instrument is gaining power (bullish) and you want to buy it (go long), you should search for a good partner – an instrument with weak momentum (one that loses power). Euro Crosses: Pairs that include the Euro as one of the currencies. Most popular currencies to go side by side with the euro are (apart from EUR/USD) JPY, GBP and CHF (Swiss Franc). Tip: The European indexes and the commodity markets are very influenced by the American market and vice versa. When the European stock indexes move up, so do the US stock indices. For Forex, it is quite the opposite. The USD goes down when the Euro goes up and vice versa when USD goes up. Yen Crosses: Pairs that include the JPY. The most popular pair in this group is EUR/JPY. Changes in USD/JPY or EUR/JPY almost automatically cause changes in other JPY pairs. Tip: Getting familiar with pairs which do not include USD is important for two main reasons:

- Having new options to trade. Pairs of these groups create new trading alternatives.

- Following their status will help us make trading decisions on the majors.

Not clear yet? Let’s elaborate: Say we want to trade a pair which includes USD. How do we choose a partner for the USD? Assume we are having a difficult time deciding on which pair to trade – USD/CHF or USD/JPY. How to decide? We will examine the present status of the pair CHF/JPY! Makes sense, right? That way we can figure out which one of the two currencies is going up and which one is on its way down. In our example, we will stick with the one going down, because we mentioned that we are looking for a currency to sell in order to buy the rising dollar. Exotic Pairs: Pairs that include one of the major currencies together with a currency of a developing market (arising countries). A few examples:

| Countries | Pair |

| United States/Thailand | USD/THB |

| United States/Hong Kong | USD/HKD |

| United States/Denmark | USD/DKK |

| United States/Brazil | USD/BRL |

| United States/Turkey | USD/TRY |

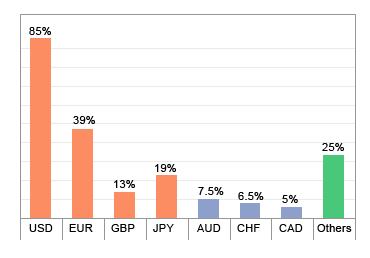

The volume of activities within this group is very low. That is why you need to bear in mind that the transaction costs that the brokers charge on trades (also known as “the spread”) with these pairs are usually a bit higher than the costs being charged on the more popular pairs. Tip: We do not advise you to take your first steps in Forex by trading these pairs. They fit mainly experienced brokers, who operate on very long period trading sessions. Exotic traders are very familiar with these exotic economies, using market forces to follow fundamental systems which you will meet later on, in the fundamental lesson. Currency Distribution in the Forex Market