Chart Patterns

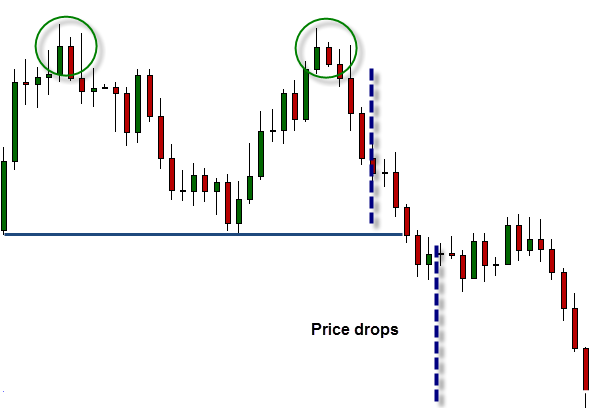

This method relies on the assumption that the market usually repeats patterns. The method is based on studying past and current trends to forecast future trends. A good pattern is like a sensor. Our sensors also forecast whether a trend will extend or make a U-turn. Think of FC Barcelona’s scouts watching tapes of Real Madrid’s last games. Their analysis will discuss where threats will probably come from. Or if you do not like football, think of a military force protecting a village. They note that over the last few days hostile groups have been gathering north of the village. Chances of hostile attacks from the north are increasing. Now, let’s focus on major forex patterns: Double Top – Describes market conditions of mixed buying and selling forces. No group succeeds in becoming paramount. Both are situated in a battle of attrition, waiting for the other to break and give up. It concentrates on the peaks. Double top occurs when a price reaches the same peak twice but does not succeed in breaking through.  We shall enter when the price breaks the “Neckline” once again (on the right). You can even enter immediately but we advise that you wait for a pullback to the neckline again and the sell, because the first break might be a fakeout. Now, check out the dramatic price fall which comes right after:

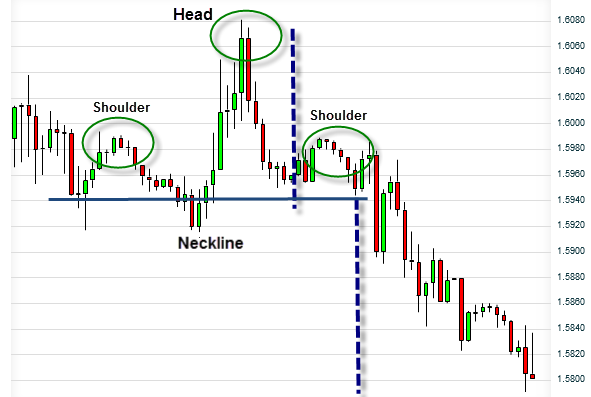

We shall enter when the price breaks the “Neckline” once again (on the right). You can even enter immediately but we advise that you wait for a pullback to the neckline again and the sell, because the first break might be a fakeout. Now, check out the dramatic price fall which comes right after:  Tip: On many occasions, the size of decline will be more or less equal to the distance between peaks and neckline (as in the example above). Double Bottom – Describes an opposite process. It emphasizes the lows. Important: Double bottom usually appears within daily sessions. It is most relevant for intraday trading, when there is a flow of fundamental announcements that affect our pair. On many occasions we are dealing with triple or even quadruple tops/bottoms. In these cases we will have to wait patiently until a breakout appears, breaking the support/ resistance. Head and Shoulders – The Head and Shoulders pattern informs us of a reversal on a “head”! Draw an imaginary line by connecting the 3 tops and you will get a head and shoulders structure. In this case, the best spot to enter a trade is just below the neckline. Also, as opposed to double top, here, in most cases the trend that follows the breakout would not be the same size as the gap between head and neckline. Watch the chart:

Tip: On many occasions, the size of decline will be more or less equal to the distance between peaks and neckline (as in the example above). Double Bottom – Describes an opposite process. It emphasizes the lows. Important: Double bottom usually appears within daily sessions. It is most relevant for intraday trading, when there is a flow of fundamental announcements that affect our pair. On many occasions we are dealing with triple or even quadruple tops/bottoms. In these cases we will have to wait patiently until a breakout appears, breaking the support/ resistance. Head and Shoulders – The Head and Shoulders pattern informs us of a reversal on a “head”! Draw an imaginary line by connecting the 3 tops and you will get a head and shoulders structure. In this case, the best spot to enter a trade is just below the neckline. Also, as opposed to double top, here, in most cases the trend that follows the breakout would not be the same size as the gap between head and neckline. Watch the chart:  The next chart shows that we are not always going to get symmetrical Head and Shoulders pattern:

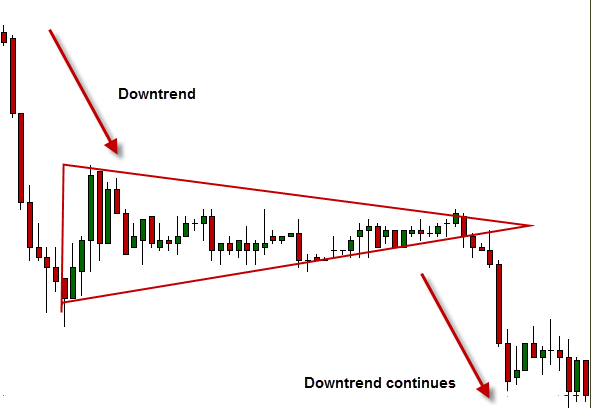

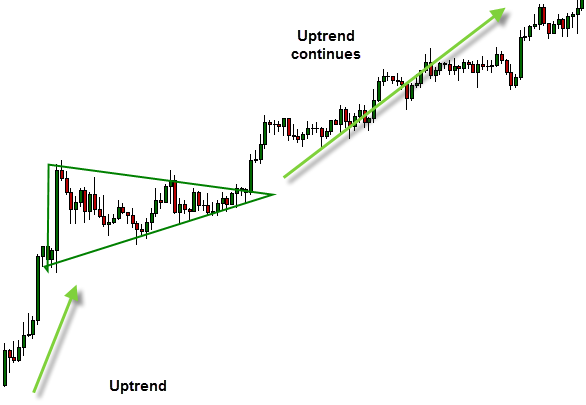

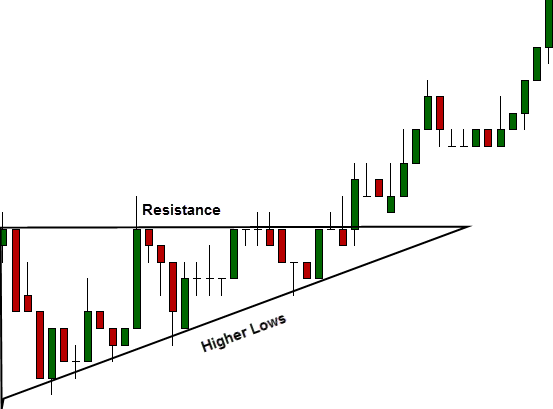

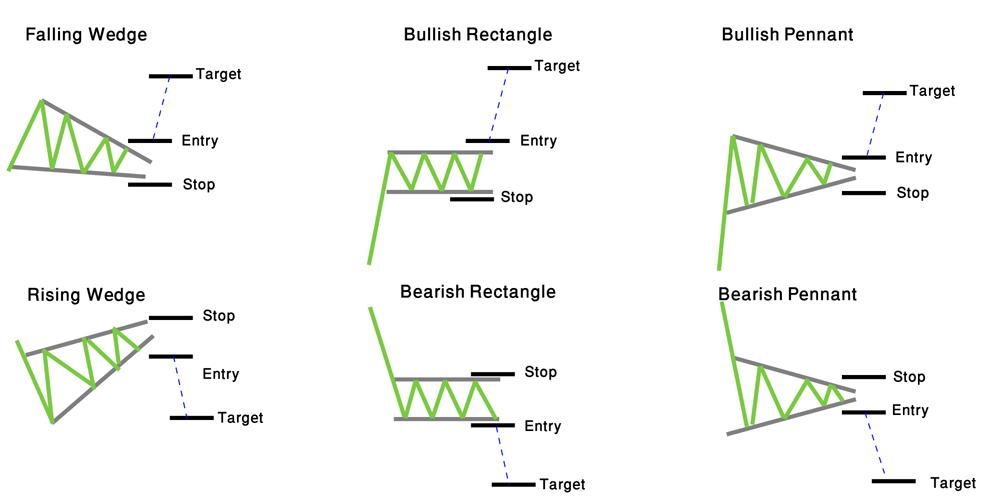

The next chart shows that we are not always going to get symmetrical Head and Shoulders pattern:  Wedges – The Wedges pattern knows how to diagnose and anticipate reversals and continuations. It works on both uptrends and downtrends. A wedge is built up of 2 non-parallel lines. These two lines create a non-symmetrical, cone-shaped channel. In an up-going wedge (with its head up), the upper line connects the tops of the highest green bars (buys) along the uptrend. The lower line connects the bottoms of the lowest green bars along the uptrend.

Wedges – The Wedges pattern knows how to diagnose and anticipate reversals and continuations. It works on both uptrends and downtrends. A wedge is built up of 2 non-parallel lines. These two lines create a non-symmetrical, cone-shaped channel. In an up-going wedge (with its head up), the upper line connects the tops of the highest green bars (buys) along the uptrend. The lower line connects the bottoms of the lowest green bars along the uptrend.  In a down-going wedge (with its head down), the lower line connects the bottoms of the lowest red bars (sells) along the uptrend. The upper line connects the tops of the highest red bars along the trend:

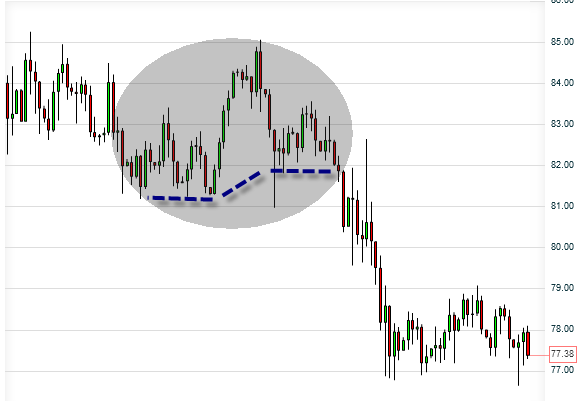

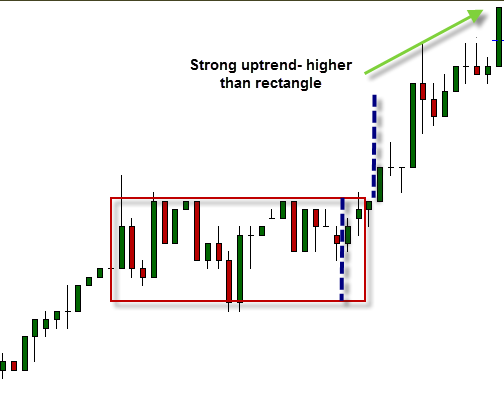

In a down-going wedge (with its head down), the lower line connects the bottoms of the lowest red bars (sells) along the uptrend. The upper line connects the tops of the highest red bars along the trend:  Entry points on wedges: we like to enter a few pips above the crossing of the two lines if it is an up-going trend and few pips below the crossing if it is a down-going trend. In most cases, the following trend will be similar in size to the current one (inside the wedge). Rectangles are created when price moves between two parallel Support and Resistance lines, meaning, in sideways trend. Our target is to wait until one of them breaks. That would inform us of a coming trend (we call it “think outside of the box”…). The following trend would be at least as high as the rectangle. Let’s see a couple of examples of rectangle forex trading strategies:

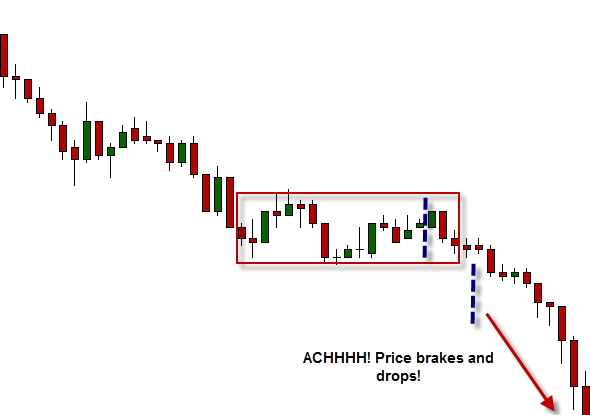

Entry points on wedges: we like to enter a few pips above the crossing of the two lines if it is an up-going trend and few pips below the crossing if it is a down-going trend. In most cases, the following trend will be similar in size to the current one (inside the wedge). Rectangles are created when price moves between two parallel Support and Resistance lines, meaning, in sideways trend. Our target is to wait until one of them breaks. That would inform us of a coming trend (we call it “think outside of the box”…). The following trend would be at least as high as the rectangle. Let’s see a couple of examples of rectangle forex trading strategies:

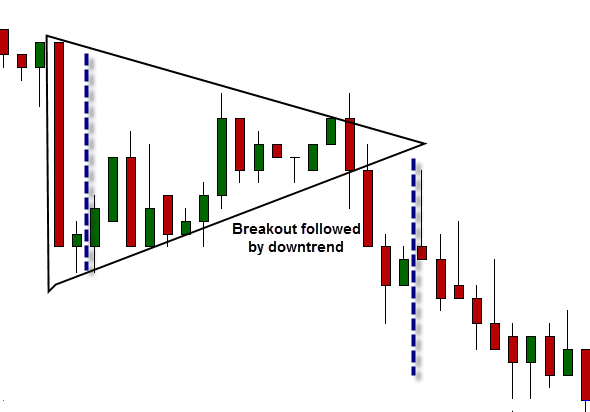

Entry point: Get ready to enter as soon as the rectangle breaks. We will take a small safety margin. Pennants – A horizontal, symmetrical, narrow triangle-shaped pattern. Appears after large-scale trends. In most cases, the direction in which the triangle breaks forecasts a coming trend in that direction, at least as strong as the previous one. Entry point: When the upper part breaks and the direction is bullish, we will open an order just above the triangle, and at the same time we will open a Stop Loss Order (remember Types of Orders in Lesson 2?) located a little below the lower side of the triangle (in case we are witnessing a Fakeout! In that case, the apparent breakout is trying to deceive us, followed by a sudden downtrend, against our predictions). We act the contrary where the lower part of the triangle breaks and the direction is bearish:

Entry point: Get ready to enter as soon as the rectangle breaks. We will take a small safety margin. Pennants – A horizontal, symmetrical, narrow triangle-shaped pattern. Appears after large-scale trends. In most cases, the direction in which the triangle breaks forecasts a coming trend in that direction, at least as strong as the previous one. Entry point: When the upper part breaks and the direction is bullish, we will open an order just above the triangle, and at the same time we will open a Stop Loss Order (remember Types of Orders in Lesson 2?) located a little below the lower side of the triangle (in case we are witnessing a Fakeout! In that case, the apparent breakout is trying to deceive us, followed by a sudden downtrend, against our predictions). We act the contrary where the lower part of the triangle breaks and the direction is bearish:

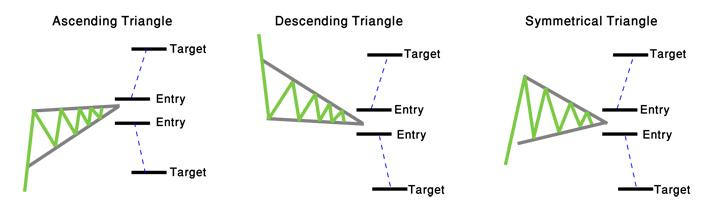

Triangles – There are 3 kinds of triangles: Symmetrical, Ascending and Descending. These patterns usually show up in an intraday trade, within short-term periods, when the market still has not decided on which direction the price is going. Example of symmetrical triangle trading strategy:

Triangles – There are 3 kinds of triangles: Symmetrical, Ascending and Descending. These patterns usually show up in an intraday trade, within short-term periods, when the market still has not decided on which direction the price is going. Example of symmetrical triangle trading strategy:  When recognizing a symmetrical triangle, you should prepare yourselves for an upcoming breakout that will point to the next trend’s direction. Entry point: Not knowing the direction of the coming trend yet, we put set interferences on both sides of triangle, just before its vertex. Once having figured out where the trend is going, we immediately cancel the irrelevant entrance point. In the example above, the trend moves down. We cancel the entrance above the triangle in this case. Another example of a triangle trading strategy:

When recognizing a symmetrical triangle, you should prepare yourselves for an upcoming breakout that will point to the next trend’s direction. Entry point: Not knowing the direction of the coming trend yet, we put set interferences on both sides of triangle, just before its vertex. Once having figured out where the trend is going, we immediately cancel the irrelevant entrance point. In the example above, the trend moves down. We cancel the entrance above the triangle in this case. Another example of a triangle trading strategy:  You can see that symmetrical triangles appear while the market is uncertain. The price inside the triangle ranges widely. Market forces wait for signs to signal the next trend’s direction (usually determined as a response to a fundamental event). Ascending triangle forex trading strategy:

You can see that symmetrical triangles appear while the market is uncertain. The price inside the triangle ranges widely. Market forces wait for signs to signal the next trend’s direction (usually determined as a response to a fundamental event). Ascending triangle forex trading strategy:  This patterns appears when buying forces are stronger than selling forces, but still not strong enough to break out of the triangle. In most cases the price will eventually succeed in breaking the resistance level and move up, but it is better to set entrance points on both sides of the resistance (next to the vertex) and cancel the lower one as soon as uptrend starts (we do this to reduce risk, because in some cases a downtrend comes after an ascending triangle). Descending triangle forex trading strategy: The descending triangle pattern appears when selling forces are stronger than buying forces, but still not strong enough to break out of the triangle. In most cases the price eventually will succeed in breaking the support level and move down. However, it is better to set entrance points on both sides of the support (next to the vertex) and cancel the higher one as soon as a downtrend starts (we do this to reduce risks, because in some cases an uptrend comes after an descending triangle).

This patterns appears when buying forces are stronger than selling forces, but still not strong enough to break out of the triangle. In most cases the price will eventually succeed in breaking the resistance level and move up, but it is better to set entrance points on both sides of the resistance (next to the vertex) and cancel the lower one as soon as uptrend starts (we do this to reduce risk, because in some cases a downtrend comes after an ascending triangle). Descending triangle forex trading strategy: The descending triangle pattern appears when selling forces are stronger than buying forces, but still not strong enough to break out of the triangle. In most cases the price eventually will succeed in breaking the support level and move down. However, it is better to set entrance points on both sides of the support (next to the vertex) and cancel the higher one as soon as a downtrend starts (we do this to reduce risks, because in some cases an uptrend comes after an descending triangle).

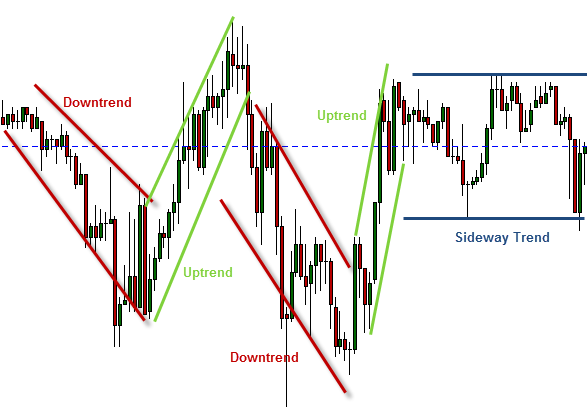

Channels

There is another technical tool that is also extremely simple and efficient! Most traders love using channels, mostly as secondary to technical indicators; In fact, a channel is built of lines parallel to the trend. They begin around the peaks and lows of a trend, providing us with good clues for buying and selling. There are three kinds of channels: Horizontal, Ascending and Descending. Important: Lines must be parallel to the trend. Do not force your channel on the market!

Summary

Patterns that inform us about trend reversals are Doubles, Head and shoulders and Wedges.  Patterns that inform us about trend continuations are Pennants, Rectangles and Wedges.

Patterns that inform us about trend continuations are Pennants, Rectangles and Wedges.  Patterns that cannot predict a trend’s direction are Symmetrical Triangles.

Patterns that cannot predict a trend’s direction are Symmetrical Triangles.  Remember: Do not forget to set ‘Stop Losses‘. Also, set 2 entries if needed, and remember to cancel the irrelevant one! So, what did we learn in this chapter? We went deeper into technical analysis, were introduced to support and resistance levels, and learned to use them. We also coped with Breakouts and Fakeouts. We have used channels and understood the meaning of price action. Finally, we studied the most popular and prominent chart patterns. Can you feel your progress toward the target? Suddenly Forex trading does not seem that frightening, right? Important: This lesson is essential to any of you who wish to trade like pros and become a Forex master. It is advised to go through it again briefly, to make sure you have got all the terms and information right, as it is impossible to turn into a professional trader without truly understanding the meaning and roles of Support and Resistance Levels! It is time to switch to maximum energy! You have now completed more than half of our course, taking huge steps towards the target. Let’s conquer our objective! The next chapter you will equip you with various technical indicators for your toolbox for Forex technical trading strategies.

Remember: Do not forget to set ‘Stop Losses‘. Also, set 2 entries if needed, and remember to cancel the irrelevant one! So, what did we learn in this chapter? We went deeper into technical analysis, were introduced to support and resistance levels, and learned to use them. We also coped with Breakouts and Fakeouts. We have used channels and understood the meaning of price action. Finally, we studied the most popular and prominent chart patterns. Can you feel your progress toward the target? Suddenly Forex trading does not seem that frightening, right? Important: This lesson is essential to any of you who wish to trade like pros and become a Forex master. It is advised to go through it again briefly, to make sure you have got all the terms and information right, as it is impossible to turn into a professional trader without truly understanding the meaning and roles of Support and Resistance Levels! It is time to switch to maximum energy! You have now completed more than half of our course, taking huge steps towards the target. Let’s conquer our objective! The next chapter you will equip you with various technical indicators for your toolbox for Forex technical trading strategies.

Practice

Go to your demo account. Now, let’s do general revision on what you have learned:

- Choose a pair and go to its chart. Identify support and resistance levels along the trend. Distinguish between weaker trends (2 lows or 2 peaks) and stronger ones (3 rehearsals or more)

- Spot support levels that turned into resistance levels; and resistances which turned into supports.

- Try to identify Pullbacks

- Draw channels along a given trend, according to the rules you have learned. Get a feeling on how it communicates a trend.

- Try to spot a few of the patterns that you have learned

- Try to spot fake-outs and think how you can avoid them